Make the most of lockdown and teach your children mental wellbeing and money sense.

FACEBOOK | TWITTER | INSTAGRAM | YOUTUBE

With schools shut down and everyone at home, many parents have found themselves in a new role: teacher.

So why not add some personal wellbeing and finance to your lesson plans?

“This is the most amazing opportunity to teach your kids something that is meaningful long term,” says Jackie Swainston, founder of CoinIt-In.com, a company teaching money mindfulness to kids.

“People have never been in an environment where they are not rushing to go to the next thing,” she says. “So, let’s go back to basics.”

At around the age of three to five years old, kids may be too young for financial concepts but you can start building a foundation by having some basic money conversations.

Between six and 12, they can start absorbing more concrete information and build healthy habits. Teens and young adults can start earning money and making their own decisions.

Get everyone working together and show how important it is to all contribute to the household. Even simple things, like getting kids to clear the breakfast things, do some planting in the garden, wash the car can all contribute to mental wellbeing and feeling of being part of something. Better still, reward them with a bit of pocket money.

For very young children, let them hold and see money. Get a pile of 1p coins and have a penny stacking race. The one with the tallest tower in a minute wins.

Tweens could create jewellery and crafts and set up a mini business.

Older teens can watch films with lessons about money – The Big Short, Wall Street, Dark Waters, Moneyball, and the Pursuit of Happyness etc. Fiction but with an insight about the money markets.

Teach them the importance of saving for an uncertain future, always having money for a rainy day – or worse.

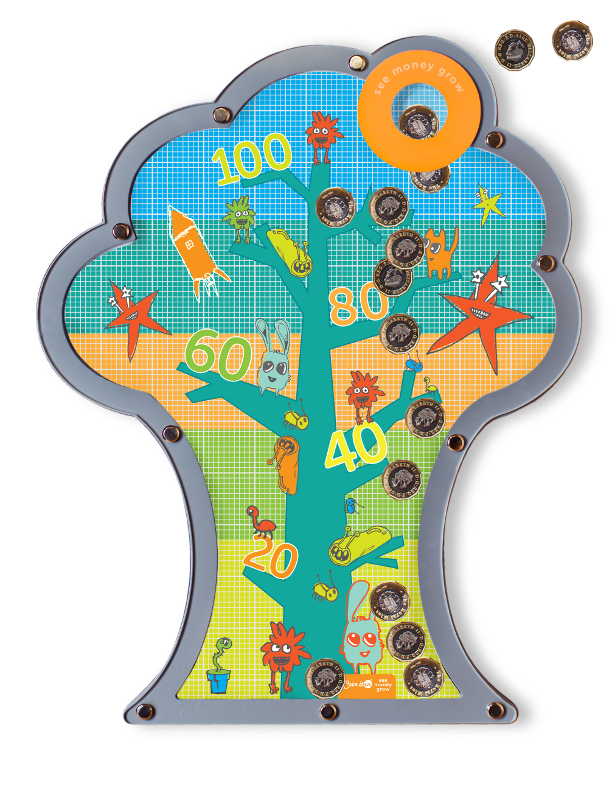

To help them see their money grow, invest in a MoneyBoxTree, a cleverly designed flat money box ‘tree’ that hangs on the wall. It holds 100 pound coins and enables children to literally see their money accumulate, coin by coin. It encourages saving and greater awareness of responsible spending in an increasingly cash-free but consumer-driven society.

Available in a range of eight beautifully illustrated contemporary designs. It retails at around £35. Visit www.coinit-in.com to shop.